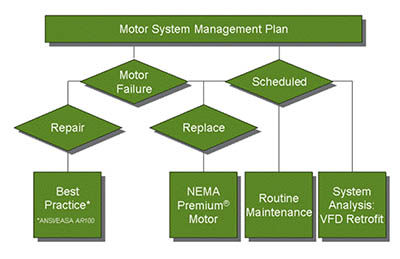

Kitt Butler, director, Motors & Drives, Advanced Energy

Corporation, Raleigh, North Carolina, says, “You want to

identify the critical motors in your process. If one motor

in the middle of the line fails, then the whole mill could go

down. You cannot just wait for that to happen; you have to

have a plan ready before that motor fails. That is the crux of

motor management: plan before the motor fails. If you allow

the motor to fail before determining what to do, then you will

typically be in panic mode and bad things can happen.”

If the plan for a particular motor is to repair or rewind

upon failure, make certain to select a service center that adheres

to guidelines established by the Electrical Apparatus

Service Association (EASA); (see www.easa.com/energy for

more information).

Motor Spares Inventory

To address downtime, motor failure policy must define a

motor spares inventory; it must support actions that minimize

costly business interruptions. According to Butler, “A

spare motor inventory is indispensable in motor management

— especially for critical motors. Spares need to be within

arm’s reach, should an in-service motor go down.”

A spares inventory program should align with plans to upgrade

motors to NEMA Premium efficiency. Upgrade spares

as well as operating motors; replacing a failed older, less-efficient

motor with another standard efficiency motor provides

no energy savings or operating cost reduction.

Johnny Douglass, retired senior industrial engineer, Washington

State University Energy Program, says, “The spares inventory

includes motors that fit more than one application;

quite often motors in the one-to-100 horsepower range can

fit into a variety of locations. Consequently, the spares inventory

should consist of NEMA Premium motors; the fact that

a motor in spares may go many places dictates that all the

motors should be NEMA Premium motors.”

MotorMaster+ inventory lists are useful for sharing with

motor distributors. If you can’t stock some motors at your

facility because of lack of budget or storage space, you can

share in-service motor inventory lists with your distributor

and ask the distributor to stock those NEMA Premium motors

on your list. In this manner spare motors are available

on short notice, but stored elsewhere.

(Note: The DOE (U.S. Dept. of Energy) MotorMaster+ software

is free to U.S. addresses, and can be obtained at: www1.

eere.energy.gov/manufacturing/ tech_deployment/software_

motormaster.html.)

There are other financial limitations to a motor spares

inventory; for example, very large motors can be expensive

to store. Scheduled monitoring of such large motors gives

advanced warning; such monitoring allows sufficient lead

times to order a new motor or arrange for a motor to be rewound

during scheduled downtime.

As the purchasing agent for Qubica/AMF, Rick Streeter has

overseen the upgrade of motor spares and knows of the above

limitations. “I try to have a spare motor for every machine

whenever possible, but some of our motors are just too big to

keep in spares here on-site. For example, we use 150 and 200

horsepower motors that are just too big to keep in spares. On

the other hand, for the smaller motors I keep at least one spare

on hand for every type of motor that we use here.”

Repair or Replace?

Horsepower breakpoint. In part I of this series (October

PTE), horsepower breakpoint was covered in the context

of the repair-or-replace decision. It is also a consideration

in motor failure policy. The policy can be as elementary as

“always replace motors under 50 horsepower” — or more sophisticated.

Useful graphs (courtesy Advanced Energy Corporation)

for picking a horsepower breakpoint can be created using

special calculators. In one such graph, the vertical axis

represents motor horsepower and the other axis represents

hours of operation. The calculator plots a curve that depends

on the cost of electricity. Once a curve is plotted it is easy

to find the horsepower breakpoint that corresponds to any

payback period of operation. (Note: Tools for calculating the

horsepower breakpoint are available on the Advanced Energy

website; also see the “Horsepower Bulletin” @ www.advancedenergy.

org/md/knowledge_library/resources/Horsepower%

20Bulletin.pdf).

Butler points out, “Surveying all the motors in a facility can

be labor intensive. It takes eyeballs and legs. One has to walk

around and look at all the nameplates of the motors, recording

and processing all that information.”

Replace at failure. Motors should be tagged for replacement

upon failure. Gilbert McCoy, P.E., energy systems engineer

with the Washington State University (WSU) Energy

Office, Olympia, Washington, advises, “Use MotorMaster+

to calculate the energy savings for each motor in your plant.

Fortunately, MotorMaster+ can accomplish this for all the

motors in the inventory with one quick batch analysis. Tag

those motors that should be replaced upon failure so the

millwrights know what to do, and which spare motors should

be NEMA Premium motors versus older standard motors.”

Opportunities for energy savings are lost when spare motors

are not properly tagged. “The millwrights are likely to

pick an old standard efficiency motor and install it,” McCoy

points out. “At that point, the opportunity is lost for energy

savings throughout that motor’s operating life — which could

be ten years or more.”

More Recommendations

Frequent failures first. Some industries kick off their motor

improvement project by identifying motors with histories of

frequent failure. Obviously, besides replacing the motors it

is also prudent to identify and correct the root cause of the

problem. EASA has developed an in-depth seminar and reference

manual on “Root Cause Failure Analysis,” according

to Tom Bishop, P.E., senior technical support specialist for

the EASA, St. Louis, Missouri.

If the cause of failure is due to a harsh environment, then

you can reduce downtime and increase reliability — while

also realizing significant energy savings — by replacing those

problem motors either with premium-efficiency motors or

premium efficiency, severe-duty motors.

The Longview complex of the Weyerhaeuser Company

in Longview, Washington serves as an excellent example. It

instituted a policy calling for all non-IEEE 841 motors of 50

horsepower or less to be replaced upon failure with energyefficient

IEEE 841-2001 models — regardless of condition,

age or rebuild history of the existing motor.

McCoy recalls, “A few years ago we had the opportunity

to work with a Weyerhaeuser pulp and paper mill. A review

of the maintenance records showed 28 motors with histories

of frequent failures; these motors would fail every two

to four years, resulting in downtime and lost productivity.

The company jump-started its motor improvement program

by immediately replacing problem motors with new NEMA

Premium efficiency motors. It chose not only premium efficiency

motors but also NEMA Premium efficiency IEEE-841 petroleum and chemical duty motors. Some manufacturers

call these motors “extra tough” or “severe duty” motors; in

addition to an expected longer operating life and long warranties,

these motors are corrosion-resistant and have lower

vibration displacements.”

(A case study on the Weyerhaeuser motor failure policy

can be found in the electrical applications section of the CDA

website: www.copper.org/environment/sustainable-energy/

transformers/education/archive/weyerhaeuser.html.)

Monitor the spares. Spare motors are supposed to be

ready to replace failed, in-service motors. But how ready are

they? If the spares are not premium efficiency motors, then

you may be better off recycling them, depending also on factors

such as hours of operation. If they are NEMA Premium

motors, then they need occasional shaft rotation to avoid

“flat-spotting” — as do all motors sitting in storage.

As Douglass notes, “A motor upgrade program must address

spares as well as operating motors. Sometimes spare

motors of standard efficiency should be recycled — even if

freshly rewound. You may be able to recover some of the cost

from the motor components inside.”

Failed EPAct motors. The decision to scrap failed EPAct

motors and replace them with new NEMA Premium motors

should be based on a lifecycle analysis. EPAct motors are less

efficient than NEMA Premium motors, and no energy savings

are realized by putting an EPAct motor back in service. A

rewound motor could be even less efficient than when it was

new; however, a service center that adheres to EASA good

practice guidelines should be able to mitigate or resolve efficiency

losses. For more information on good practices, visit

the EASA website (www.easa.com/energy).

McCoy contends, “When we do our motor assessments, we

look mainly at replacing standard-efficiency motors — when

they fail — with NEMA Premium efficiency motors. Nonetheless,

depending on operating hours and utility rates, many

times it is also cost-effective to junk EPAct efficiency motors

when they fail and replace them with new NEMA Premium

efficiency motors.” Standardizing on T-frame motors also reduces

the number of motors that must be maintained in the

on-site spares inventory.

Oversized motors. Research shows that the efficiency of

most motors peaks for loads between 70 – 75 percent, and

declines below 50 percent. The situation is different for large

motors, however, according to McCoy. “Motor assessment

staff generally believe oversized, under-loaded motors are

bad,” he says. “They recommend replacing motors loaded

to less than 50 percent of their full load with smaller motors

matching load requirements. But large, standard efficiency

motors should not be replaced with smaller, standard efficiency

motors. The energy savings will be small or non-existent

because larger motors typically have higher, full-load

and part-load efficiencies than smaller motors. Large motors

generally maintain a high efficiency all the way down to 25

percent of load. The benefit comes from replacing oversized

motors with a smaller premium efficiency motor matched to

load requirements.”

summarizes, “Efficiency may be higher for larger

motors than for smaller motors, but it is still reduced when

not matched to the load.”

Minimize downtime with severe-duty motors. The true

cost of downtime is difficult to calculate and often underestimated.

Downtime is the subject of countless process

improvement projects within a typical company — which

speaks to its importance. A plant typically loses several percent

of its production capacity because of downtime; and

most plants do not calculate downtime costs accurately, underestimating

the total cost by 200 or even 300 percent.

Bruce Benkhart, director, Advanced Proactive Technologies,

Springfield, Massachusetts adds, “Downtime is crucial

to any facility, whether an office, a hospital, or an industrial

plant. Whether they are making widgets, cars or pharmaceuticals,

downtime means that production stops and profits

plummet. Downtime is ultimately the most important consideration.”

McCoy gathered data on the cost of downtime at a pulp

mill in British Columbia. “Downtime is critical for industrial

plants,” he says. “This pulp mill had a capacity of about 1,100

air-dried-metric-tons-per-day. We calculated the value of

the pulp produced at $25,000-per-hour at a price of $600-perton.

In the case of this pulp mill, the cost of downtime is

huge. The reliability and uptime benefits from new premium

efficiency motors can dwarf the energy costs. To realize these

benefits, motor managers in the mills and process industries

preferentially purchase “severe-duty” motors — or IEEE-841

petroleum and chemical duty motors.

“In a severe processing environment, replacing existing

motors with NEMA Premium severe-duty motors makes

good business sense, especially when downtime is critical,”

says Bishop, “but a severe-duty motor in a non-severe duty

application probably won’t save more energy than other motors

of the same efficiency.”

Frame adapters. Adapter rails and bases have been available

for decades. They are used to install T-frame motors in

systems designed for older U-frame motors.

Motor interchangeability is common today because of the

standardization of frame sizes. Motors of the same horse

power, speed and enclosure normally fit the same frame size,

even though the motors are from different manufacturers. In

other words, if the motors are in standard frame sizes, then

a motor from one manufacturer is interchangeable with a

similar motor from another.

Yet, in some situations, the frame sizes are not the same.

Motors have become more compact for a given horsepower,

primarily due to better insulation (Class H at 180° C) that

allows motors to run much hotter in a smaller package (Tframe).

What do you do when you find a motor of the older

U-frame type in your facility?

Regarding frame sizes, McCoy comments, “Motor manufacturers

make premium efficiency U-frame motors, but

such motors carry a considerable cost-adder. When we see

old U-frame motors in a plant, we know they are likely to be

repaired when they fail. They are often returned to service

because the mounting bolts and shaft heights for those motors

are different than those of a T-frame motor. Nonetheless,

we encourage the purchase of frame adapters or transition

bases, which ideally would be maintained in the spares warehouse and readily available when an old U-frame motor

fails. In this manner the old motor can be easily replaced

with a modern T-frame motor.”

Purchasing Specifications

Purchasing specifications cover a wide gamut of elements;

they identify and specify what motors to stock and how

many, and they document the decision-making process. The

following sections outline some key considerations relating

to the development of purchasing specifications.

Develop corporate support. Organizationally, energy efficiency

management tends to be a fractured process. A disconnect

often occurs between plant maintenance, engineering,

purchasing and finance. Cooperation needs to evolve

into teamwork before advances in energy savings can happen.

Rob Penney offers some insights on organization; he is senior

energy engineer for the Washington State University Energy

Program, as well as a professional mechanical engineer

and certified energy manager. He is responsible for the energy

savings team, business development and energy project

deliverables at WSU. “Within a business, purchasing makes

motor purchases, accounting pays the energy bill, and engineering

looks at the process,” he says. “They often do not

communicate effectively with each other. Only when each

pays attention to the motor systems, and they all work together

as a team, can they bring it all together, making good

motor management decisions and really saving energy.” The

team approach lends itself nicely to gaining corporate support.

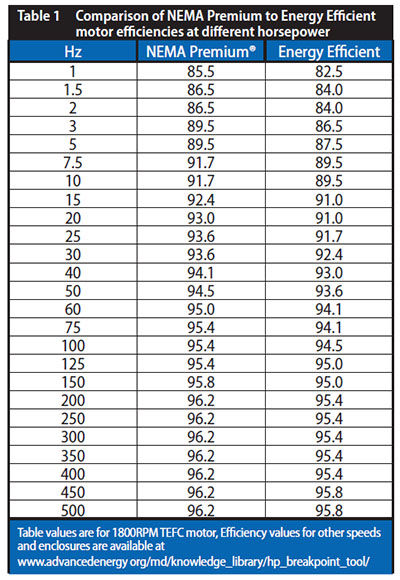

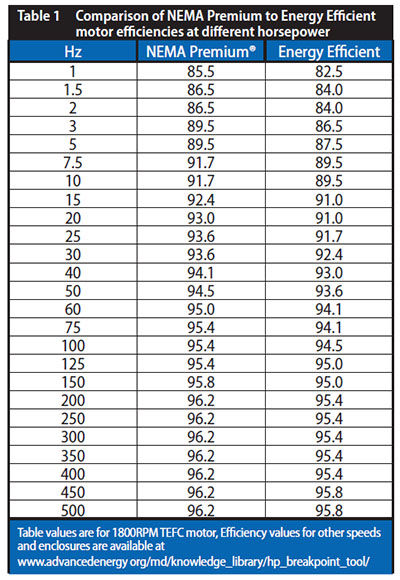

Official mandates. Butler at Advanced Energy reminds,

“EISA was signed into law by George Bush in 2007. It covers

many energy-related topics,

including motors, and became

effective December 2010. For

general purpose motors from one

horsepower to 200 horsepower,

EISA raised mandated efficiency

levels above the levels of EPAct

legislation of 1992.” (See Table 1

for comparison of EPAct to EISA

efficiencies at various horsepower.)

Butler continues, “The Department

of Energy is mandated by

Congress to expand the efficiency

envelope for electric motors. It

has done so since 1992 without

using exotic materials and designs,

but it is reaching a point of

diminishing returns. Meanwhile,

the industry, efficiency advocates,

and other stakeholders are

recommending to the DOE that

it consider motors not previously

covered; for example, motors

with mechanical alterations that

do not affect motor efficiency

Gear motors are a good example.”

Prior to EISA, OEMs were motivated mainly by cost and

reliability; efficiency wasn’t a high priority. But now that has

changed. Emmanuel Agamloh, Ph.D., P.E., motor systems

engineer for Advanced Energy, says “We hear a lot about efficiency

now. OEMs are paying attention to the efficiency of

their motors in their equipment. The EISA legislation is playing

a vital role because the increase from EPAct to NEMA

Premium efficiency levels directly affects the choice of motors

by equipment manufacturers. At Advanced Energy we

often receive requests from OEMs to verify that electric motors

meet the EISA efficiency levels so they can be put in the

OEM equipment.”

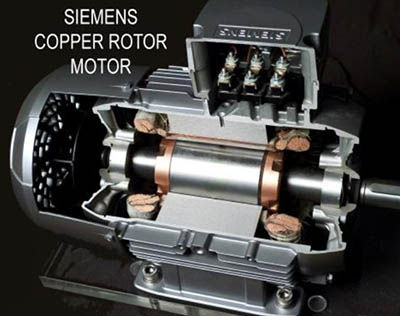

Even higher efficiency. Some motor technologies provide

even higher efficiencies than NEMA Premium; referring to

the CDA’s technical reference library, induction motor engineers

have long known that replacing die-cast aluminum

with copper in the rotor squirrel cage reduces motor losses

by as much as 15 – 20 percent — thereby improving energy

efficiency.

Meanwhile, motor manufacturers have improved on copper

rotor technology to the point that copper-rotor motors

often exceed the NEMA Premium efficiency standard by a

few percentage points (Fig. 2).

As McCoy points out, “The highest standard for motor efficiency

is designated NEMA Premium; yet some motors built

with advanced technology exceed that standard by at least

a fraction of a percentage point or even by a few percentage

points. Those motors are often built with cast copper in the

rotor, or permanent magnets in the rotor for motors operated

exclusively with variable frequency drives.”

The advantages of permanent magnets might not be realized

with smaller motors.

MotorMaster+ includes an embedded,

motor-manufacturer inventory

of 17,000 motors, along with a priceand-

performance database. The program

allows search results of motors

to be listed in descending order of

full-load efficiency.

McCoy says, “Below twenty horsepower,

copper-rotor motors are likely

to be at the top of the energy listing.”

Discounts and incentives. Pay

attention to discounts as you make

payback calculations; they can be

significant. Look for discounts from

your distributor. List prices are

merely starting points for price negotiation.

Take advantage of volume

purchases and any available energy

program rebates.

“The catalogues and websites of

motor distributors give the list price

for each motor,” McCoy says. “The

truth is that manufacturers seldom

sell motors at list price and often offer discounts. The more motors an industry buys, the bigger

the discount they are likely to get. If I were to place a large

order directly with a motor manufacturer, I might then enjoy

a discount as big as 65 percent off the list price. Typically,

large industries achieve discounts of about 50 percent from

their local distributor.”

Terry Blodgett, branch manager (retired), Kaman Industrial

Technologies, Watertown, New York says, “The price of a

motor depends on the quantity ordered at one time. Buying

one at a time versus several at a time has a significant impact.

You could replace your motors one at a time, but if you buy

in multiples the discount will be much greater, and you will

have much more buying power to develop a much stronger

price if you buy plant-wide. The lower the price, the shorter

the payback period.”

Figure 2 Below 20 hp, copper-rotor motors are likely to be at the

top of the energy listing.

- Click image to enlarge

Incentive programs provide additional savings. State programs

may provide financial incentive to assist end users in

purchasing energy efficient products.

NYSERDA (New York State Energy Research and Development

Authority) supported an incentive program in New

York State for many years. Benkhart says, “Applied Proactive

Technologies has been running the NYSERDA motors program

since 2002. Originally, the premium efficiency motor

program in New York State was strictly an incentive program

for the distributor and end user. It was funded by a systems

benefit charge that applied to all users of electricity. This

particular program provided an incentive to move up from

EPAct motors to premium efficiency motors; it was essentially

a rebate to bring down the cost of owning more efficient

motors. It provided an incentive to the distributors to

move those products and was a win-win program for both

the dealer and the user. It was quite effective in achieving

much higher penetrations of the more expensive — but more

efficient — NEMA Premium motors than would otherwise

have been the case.”

Other states may have similar programs worth investigating.

Since EISA legislation mandated NEMA Premium motors,

many utilities have discontinued their rebate programs.

Nonetheless, it is worthwhile to investigate whether “above

NEMA Premium” incentive programs exist following the enactment

of EISA on December 19, 2010. The “above NEMA

premium” efficiency designation often is referred to unofficially

as “ultra-efficient” or “super-efficient.”

Motor sizes and quantities. What motors should I stock

and how many? The goal is to match the most efficient motors

for the job to your needs. The following sections will provide

some insight to help you decide.

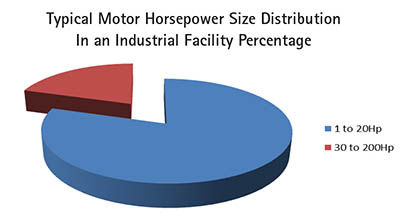

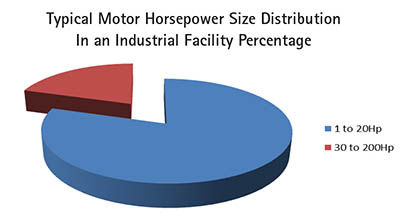

Figure 3 Percentage of motors in facilities by horsepower.

- Click image to enlarge

Small Motors, Big Savings

Eighty percent of the motors in most facilities are 20 horsepower

or less (Fig. 3). These have lower efficiencies than

larger motors, so there is an opportunity for significant gains

when they are replaced with NEMA Premium motors.

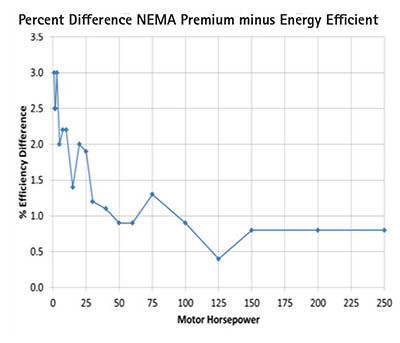

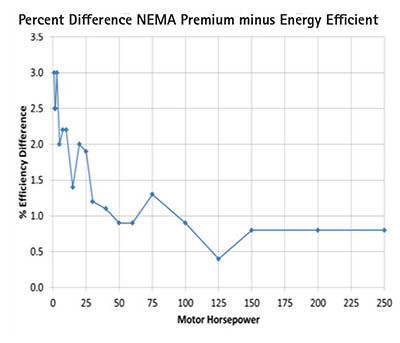

A graph (Fig. 4) — Motor Horsepower versus Percent Efficiency

Difference — was created using the efficiency table

from Advanced Energy. It illustrates the one-to-three-percent

efficiency gain that can be realized for motors up to 50

horsepower. The biggest improvements are for motors up

20 horsepower. Motors above 50 horsepower present lesser

percentage gains in efficiency.

Douglass explains, “The emphasis has been on larger motors.

That’s an appropriate starting point for your plan, but

smaller motors are important, too. They typically are more

numerous and the gain is much higher. Smaller motors of

the standard type with efficiency in the 80 percent range allow

for more improvement. If you have many of these motors

then you can save a great deal of energy. Sometimes a facility

has a huge number of small motors driving things, such as a

conveyor belt system; upgrading to a more efficient standard

results in huge savings.”

Severe-Duty Motors

In harsh operating environments, or whenever motors frequently

fail, IEEE-841 severe-duty motors are a good option.

McCoy provided an example through his work with the mill

in British Columbia. He concludes, “There are two reasons

why they were looking at extra-tough IEEE 841 petroleum

and chemical duty motors and severe duty motors. One is

the perception that the motor is going to last longer with

more uptime; the other reason is that these motors carry a

longer warranty. Generally, IEEE-841 motors have a five-year

warranty and NEMA Premium motors about three years; for comparison, general purpose motors and even EPAct efficiency

motors typically are warrantied for only one year.”

A final example comes from Joe Anderson, maintenance

manager at Interface Solutions, Beaver Falls, New York — the

largest producer of automobile gaskets. He is highly motivated

to minimize downtime using IEEE-841 motors. “We

depend on the reliability of the severe-duty NEMA Premium

motors to minimize the shutdowns resulting from rooftop

fan motor failures,” he says.

Figure 4 Motor horsepower vs. percentage efficiency difference.

- Click image to enlarge

Payback Calculations

Payback calculations are essential. Returns on investment in

9–24 months make sense. But where an EPAct or older motor

is used in an intermittent duty application, where the motor

runs only a few hundred hours a year, removing a functional

motor for replacement with a new NEMA Premium motor

is not a good investment. Look for applications with a quick

payback period.

Sharing Inventory Data

Distributors are invaluable. They see your present needs and

anticipate your future needs; they can also alleviate some

storage space concerns. Distributors understand what motors

are available and can provide appropriate solutions.

Kenny Jacobs, controls and drives product manager for KJ

Electric, Syracuse, NY, describes the relationship between a

distributor and its customers. “As an EASA motor shop, KJ

Electric provides motor survey assistance to its industrial

customers. This assistance includes, for example, helping its

customers minimize inventory by cross-referencing the one

motor that is suitable for replacing multiple motors.”

McCoy concurs, “MotorMaster+ is useful when you have

an in-service motor inventory because you can share inventory

data with your motor distributor. You can easily discuss

with the distributor which additional motors you are likely

to buy and which he should keep in stock. In this manner,

premium efficiency motors are ready to use in a spares inventory

at the distributor’s storeroom instead of your own

warehouse.”

Systems Approach

Look for energy savings in the entire system. The system extends

from the step-down transformer at the switchyard or

plant service entrance, to the motor-driven equipment and

process controls. Anything you can do to reduce system losses

saves energy.

Benkhart notes that “The motor represents a huge opportunity

for energy savings, but motors also are attached to systems.

Whether a pump, air conditioner, or compressor — the

system has its own associated losses. While many systems

would benefit from variable frequency drives, other savings

beyond the motor are possible. You have the transmission

via a belt, a pulley or a direct drive; and then the system itself.

The energy savings could be massive. There could be 50

percent savings in the system itself absent the motor. Before

embarking on those system challenges, however, start with a

motor that is the most efficient it can be.”

Variable Frequency Drives

Fans, mixers, conveyers and pumps are all good candidates

for variable frequency drives, or VFDs, which match motor

speeds to varying load requirements. VFDs enable motors

to run at speeds lower than the rated speed. Less energy is

wasted and in-line flow restrictions such as throttling valves

or inlet discharge dampers can be eliminated.

One believer in VFDs is Douglass, who says, “Often some

of the greatest savings are realized by converting fixed speed

drives to variable frequency drives. In airflow or liquid flow

situations, a motor often drives a fan or pump and an air

damper or a valve modulates the flow. In these situations,

double-digit savings can be realized by converting to an electronic

variable frequency drive. These motor controllers can

be retrofit to an existing motor application and accomplish

tremendous savings by eliminating the pressure drop associated

with a modulating valve or a damper, whose functions

are replaced by simply slowing down the speed of the motor.

In these situations, you can save as much as 40 percent in

electrical energy costs, depending on the fraction of time the

system operates at a lower flow.”

VFDs are cost-effective; they increase productivity, lower

operating costs and waste less energy. Joe Anderson at Interface

Solutions comments, “Our plant’s variable speed drive

inverter duty ready NEMA Premium motors are working

very well. Our process needs exact amounts of flow, and the

loads vary all over the place. With the variable speed drives,

we can better control the process.”

Match Motors to Load

Overloaded motors tend to run hotter; motors that run too

hot tend to fail earlier than motors matched properly to the

load. The life of the motor insulation is reduced by one-half

for every 10° C rise in motor temperature.

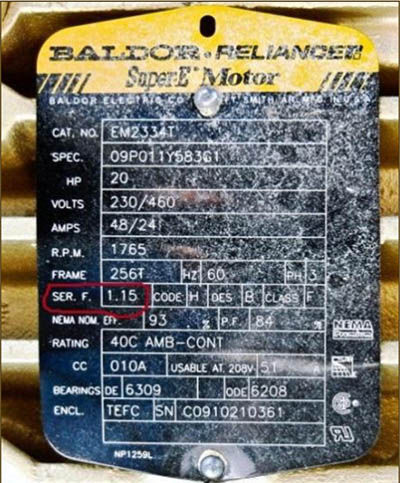

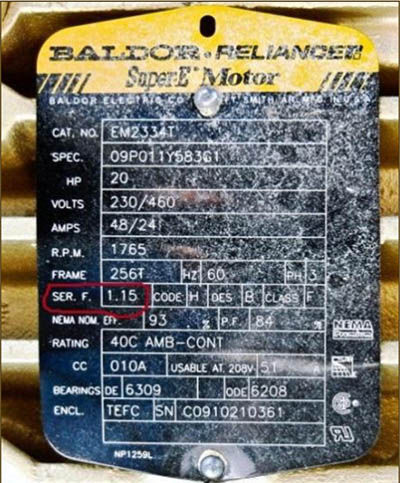

Motors can run somewhat overloaded for short time periods.

The nameplate on the motor gives a service factor multiplier

that is the percent-operational-overload acceptable for the motor. A service factor of 1.15 indicates the motor can

operate 15 percent overloaded without seriously damaging

the motor, but one should not expect the best performance

or maximal service life.

As an example, see the image of the nameplate (Fig. 5)

from a Baldor Reliance motor whose service factor of 1.15 is

circled in red in the image, i.e. — SER. F. 1.15.

So far, it has been assumed that the supply voltage is within

specified limits. An under-voltage contributes to an overheating

condition, too, putting undue stress on a motor.

Douglass says, “When matching the motor to the load,

be careful to not undersize the motor. It is particularly bad

when the motor is undersized and the voltage is under voltage.

This combination tends to make the motor run too hot.

When a motor runs hot its service life is shortened. Even if

the voltage is correct an undersized motor running into its

service factor will be operating at a temperature higher than

its design temperature — thus shortening its life. Service

factors are often 15 percent, but can be as low as 0 percent

when the motor is controlled by an adjustable speed drive.

Sometimes the service factor can be higher than 30 percent.

One should never plan to operate very much or often in the

service factor.”

Space Constraints

Be cognizant of space limitations when specifying a motor

as a replacement for existing EPAct or standard-efficiency

applications. Not all of the motor dimensions are specified

in NEMA standards; some motor dimensions are specific to

each motor manufacturer.

Check a “NEMA Motor Dimensions Reference Chart”

against your space limitations or contact your motor distributor

for any dimension in question.

McCoy adds, “NEMA has a frame assignment series. Motors

are interchangeable parts. Premium efficiency motors,

energy efficient motors, and standard efficiency motors all

have the same mandated dimensions and tolerances set by

NEMA. The one difference between a premium efficiency

motor and a standard efficiency motor

is that the former may stick out further

in the off-drive end direction. If you are

space-constrained, then talk with your

motor supplier to obtain the dimensions

of the new premium efficiency

motor and ensure it fits before you

place an order.”

Figure 5 Baldor Reliance motor with service factor

multiplier (circled in red) of 1.5.

- Click image to enlarge

Financial Feasibility

Is the move to these energy-efficient

products financially feasible? The answer

is a resounding “Yes!”

Energy-efficient motors are among

the best investments available, especially

considering the high cost of energy

and today’s uncertain economic

environment. Electric motor-driven

equipment accounts for 30–50 percent

of the electricity consumption in commercial

facilities in the United States. Industrial facilities

consume 60–70 percent.

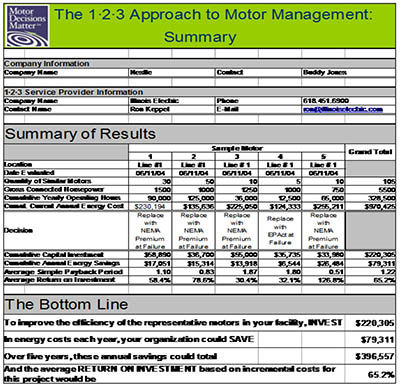

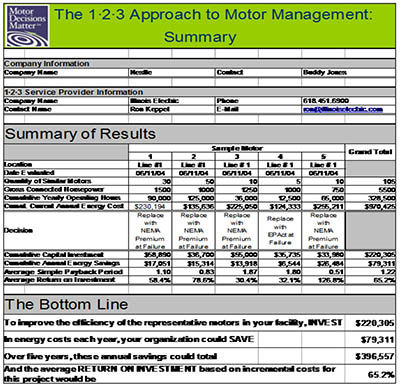

Figure 6 Example spreadsheet from 1-2-3 Approach to Motor Management

Summary, from Motor Decisions Matter.

- Click image to enlarge

Butler advises, “Motors belong to a very important electric

technology classification because they use a lot of energy.

The lifecycle costs of an electric motor are comprised mostly

of payments for electricity. Anywhere from 97– 98 percent

of the total lifecycle cost is for electricity; only two to three

percent is invested in the initial capital cost to purchase that

motor and in the maintenance cost as well. When considering

a new motor purchase, it is very important not to focus

just on initial price but focus mainly on the efficiency of the

motor. In the long run you will mostly be paying for the energy

consumed by the motor.”

Simple payback analysis shows the move to energy efficient

products is feasible. Computing the return on your

financial investment before investing the capital dollars is

possible where energy is a factor.

Says Benkhart, “In the move to more expensive — but

clearly more efficient products — the important considerations

are the price of the new motor and the cost of operating

a motor. While an incentive program helps reduce the

purchase price of a higher-cost NEMA Premium motor, there

is still the bigger expense of operating the motor. Reaching

the correct answer requires many pieces of information, including

the type of motor, how often the motor is in operation

(duty-cycle, single or multiple shifts), the horsepower,

the motor efficiency and the percent motor load as well as

the local cost of electricity, which typically ranges from $0.04

or $0.10 per kilowatt-hour. By entering the data collected

during an inventory into a software tool such as MotorMaster+,

a range of payback periods for a variety of operating

parameters and utility costs can be calculated. The resulting

payback calculations will help determine the feasibility of

going forward with new, efficient, NEMA Premium motors.”

Benkhart adds, “Most companies will approve a decision

to buy energy saving equipment if the investment meets

the simple payback or ROI requirement of less than 18 – 24

months. For a motor operating more than 6,000 hours at

roughly $0.10 per-kilowatt-hour, the

analysis yields a simple equation that

estimates payback somewhere between

six and twenty-four months. If

the extra cost of buying the new NEMA

Premium motor is $300 but the annual

energy savings is $400, the nine-month

payback clearly meets the payback criteria.

Such information gleaned from

our assessments and software tools

empowers the customer to make good

financial decisions regarding energy

efficiency. Absent motor population

information and tools to collect and

analyze the data to make an informed

decision, the facility is running blind.”

There are many tools to help make

such payback decisions. Besides MotorMaster+,

many motor manufactur-

Figure 5 Baldor Reliance motor with service factor ers offer their own proprietary tools.

Advanced Energy Corporation, for example, has a motor

management spreadsheet.

A sample spreadsheet is shown in Figure 6. It is derived from

the Motor Decisions Matter 1-2-3 Approach to Motor Management

tool at www.motorsmatter.org/tools/123approach.

html.

This spreadsheet allows five motors to be examined alongside

additional quantities from similar motors. It is an excellent

tool for calculating payback and energy savings. The

user is required to provide accurate information regarding

repair costs and new motor pricing.

Summary

A motor failure policy built on the information provided in

this work removes risk and indecision from the picture when

a motor failure occurs. For example, tagging every spare and

in-service motor in the facility with actionable information

ensures that wrong decisions will not be made due to lack of

such information.

Whether the policy stipulates replacing any motor under

a certain horsepower, installing IEEE 841 motors in place of

critical motors, or adherence to EASA guidelines for when

repair is appropriate, you have taken the steps to minimize

costly downtime and business interruptions.

Purchasing specifications developed using the technical

tools and industry resources presented in this publication

could serve as the blueprint or reference document for

your motor management plan. The document can specify

what new technologies to invest in, such as ultra-efficient

copper-rotor motors or VFDs; it can specify the number of

commonly used motors to stock in your facility; and it can

specify the tools to assess which motors are most efficient

and which yield the highest energy savings and shortest time

to payback. The purchasing specifications can also identify

preferred motor distributors, who provide the best volume

discounts, as well as pre-sales and post-sales support.

Although the percentages certainly require updating, it is

worth mentioning that the U.S. Department of Energy reported

in 1998 that only 11 percent of customers had written specifications

for motor purchases and only two-thirds of those

customers included efficiency in their specifications.

Acknowledgements

CDA acknowledges the assistance of government and industry-

based motor experts in the creation of the Motor Management

Best Practices series. Contact information for the

motor experts cited in this publication is as follows:

Emmanuel Agamloh, Ph.D., P.E. Motor Systems Engineer

Advanced Energy Corporation, Raleigh, North Carolina

(919) 857-9023, eagamloh@advancedenergy.org.

Bruce Benkhart, Director, Advanced Proactive Technologies,

Springfield, Massachusetts. Mr. Benkhart is available at

(413) 731-6546 bruce@appliedproactive.com.

Tom Bishop, P.E., Senior Technical Support Specialist,

Electrical Apparatus Service Association (EASA), St. Louis

Missouri. http://www.easa.com.

Kitt Butler, Director, Motors and Drives at Advanced Energy

Corporation (AEC), Raleigh, North Carolina (919) 857-

9017.kbutler@advancedeneergy.org.

Johnny Douglass, Retired Senior Industrial Engineer,

Washington State University (WSU) Extension Energy Program

(360) 956-2086 douglass.johnny@gmail.com.

Gilbert A. (Gil) McCoy, P.E. Energy Systems Engineer with

the Washington State University (WSU) Energy Office, Olympia,

WA. 360) 956-2086, mccoyg@energy.wsu.edu.

Rob Penney, P.E., Certified Energy Manager, Senior Energy

Engineer at Washington State University (WSU). Mr. Penney

is available at (360) 628-2053, penneyr@energy.wsu.edu.

Emmanuel Agamloh

|

Bruce Benkhart

|

Tom Bishop

|

Kitt Butler

|

Johnny Douglass

|

Gilbert A. (Gil) McCoy

|

Rob Penney

|