The Electric Steel Dilemma and Its Impact on Motor Vendors

Industrial and commercial motor suppliers are at the helm of a major problem. Historically, vendors like ABB, WEG, Siemens, and Nidec have had minimal difficulty securing supply of key raw materials used in the manufacturing of their motors. Of course, there have been many supply disruptions throughout the market’s life, but very few have evolved into longer-term issues. However, we are beginning to observe one supply disruption that will likely challenge motor vendors’ ability to produce for years to come.

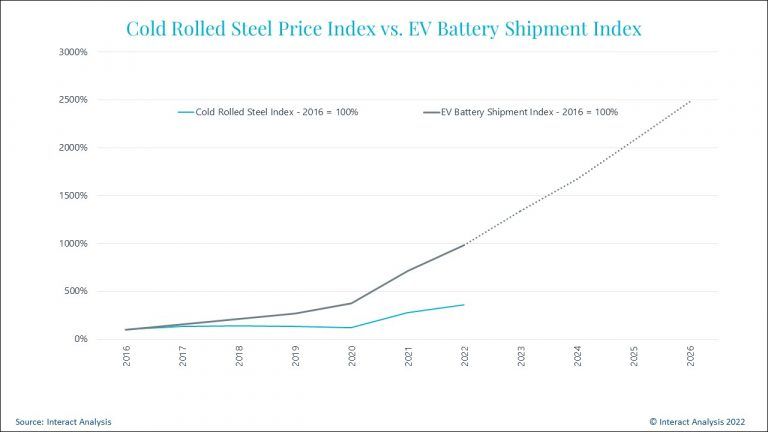

Electric steel is used heavily in the manufacturing of electric motors. The material is key to producing the electromagnetic field used to turn the rotor. Without the electromagnetic properties associated with this iron alloy, the performance of electric motors would be substantially compromised. Historically, motors used in commercial and industrial applications have represented a major customer base for electric steel suppliers, and motor vendors have resultingly had little difficultly ensuring prioritized supply lines. However, the share of business held by commercial and industrial electric motor vendors is being threatened by the automotive sector in the wake of electric vehicles.

As electric vehicle production continues to grow, so does the associated demand for the electric steel used in the motors to power them. Resultingly, the bargaining power between commercial/industrial electric motor vendors and their steel suppliers is becoming increasingly undermined. As this trend progresses, it will impact vendors’ ability to secure the electric steel necessary for production, resulting in longer lead times, and higher prices for customers.

The State of This Problem Today

The process which takes place after crude steel is formed dictates the kinds of things the material can be used for. One of these processes is referred to as “cold-rolling”, which produces what is known as “cold-rolled steel” – the type used in electric steel. Cold-rolled steel makes up a relatively small portion of overall steel demand and the process is notoriously capital intensive. Resultingly, increases in production capacity are slow.

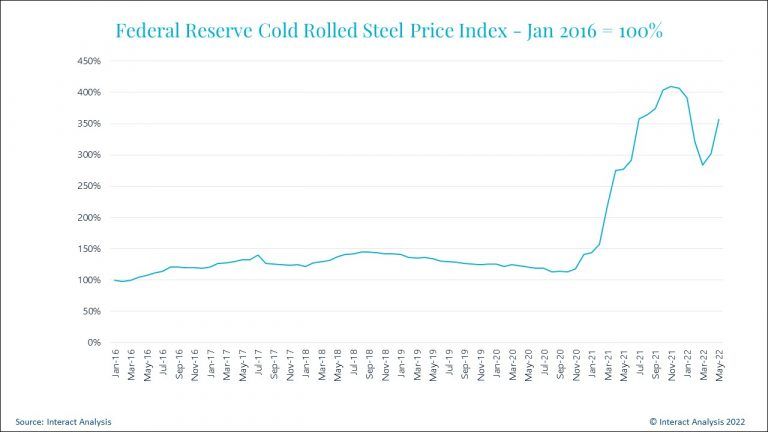

Over the last 1-2 years we’ve seen the price of cold-rolled steel climb to historic levels. The federal reserve tracks the price of cold rolled steel globally. Shown below, the price of the commodity rose to more than 400% of its price in January of 2016.

Power Transmission Engineering is THE magazine of mechanical components. PTE is written for engineers and maintenance pros who specify, purchase and use gears, gear drives, bearings, motors, couplings, clutches, lubrication, seals and all other types of mechanical power transmission and motion control components.

Power Transmission Engineering is THE magazine of mechanical components. PTE is written for engineers and maintenance pros who specify, purchase and use gears, gear drives, bearings, motors, couplings, clutches, lubrication, seals and all other types of mechanical power transmission and motion control components.