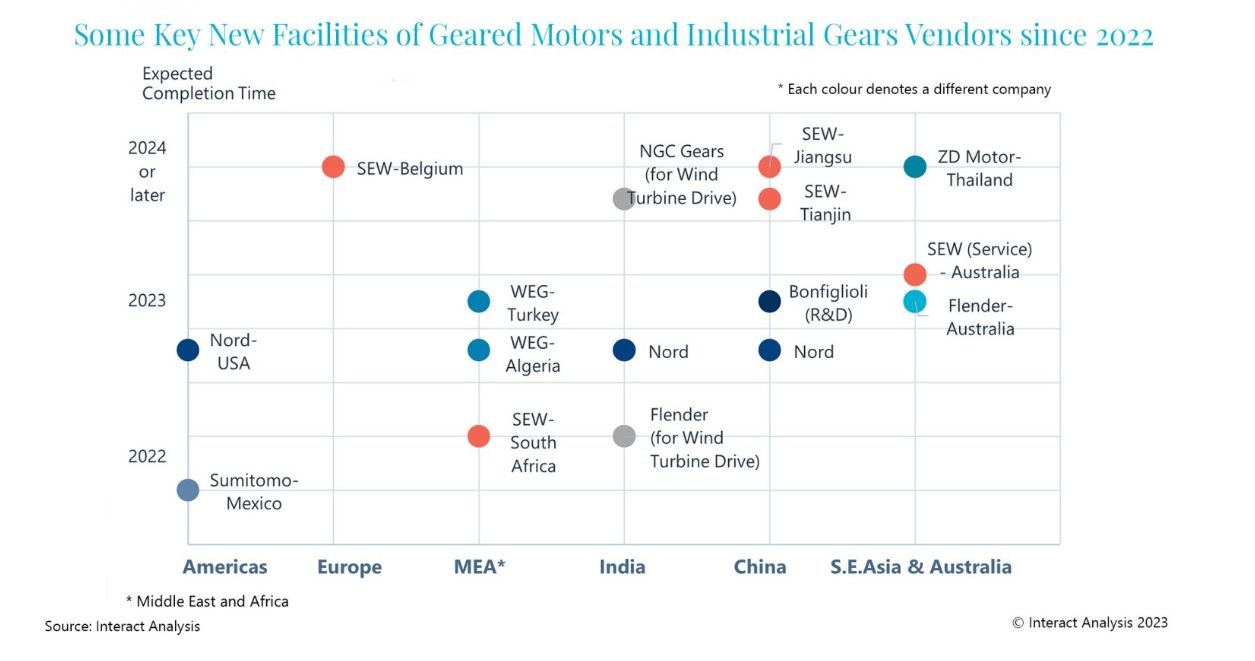

For example, growth opportunities in emerging markets like Africa, the Middle East, India and Southeast Asia have attracted investments. SEW South Africa expanded its headquarters in 2022, WEG built a motor factory in Turkey last year, NGC Gears broke ground on a new facility in India, Chinese supplier ZD Motor plans to build a factory in Thailand, etc. Some gearbox vendors increased business in India, as their clients move production from China to India, while at the same time some of the largest gearbox vendors continue to expand facilities in China (such as SEW, Bonfiglioli and Nord). All these local investments emphasized benefits such as supply chains closer to the market, shorter delivery times and improved local services. It is reasonable to assume vendors view localized production as a long-term strategy, rather than as a stopgap solution during the Covid-19 pandemic.

The Trend Towards Energy Saving

In this year’s research and interviews, Interact Analysis feels that the market is paying more attention to energy saving compared with previous years, and products such as permanent magnet direct drive motors and high-efficiency motors were mentioned frequently.

Across different regional markets, the mining industry has always been the most active sector in adopting permanent magnet direct drive motors, with typical scenarios including conveying and lifting. In addition, direct drive motors can also be found in mills in the aggregate industry and in high-end cooling towers. As a result, it is primarily the heavy-duty industrial and planetary gearboxes used in mining and aggregate industries that are facing the risk of being substituted by direct drive motors.

Compared with the traditional ‘motor and gearbox’ drive structure, the biggest advantage of a direct drive motor is saving energy, so it is favored by users in energy-intensive industries to help them meet energy consumption criteria. Secondly, the mining industry has significant gearbox maintenance demands, so using a direct drive solution can remove the tedious task of lubricating the reducers. Therefore, for some end-users, especially those in the mining industry, the benefits of direct drive motors outweigh the disadvantages of a cost premium.

According to research and interviews, Interact Analysis finds that, compared with Europe and the United States, Chinese gearbox vendors feel the most obvious threat to their products from being replaced by direct drive motors. In the Western market, direct drive motors are not considered a substantial threat in the short term. Some users in Europe and North America actively tried direct drive motors in previous years but the elevated price of the products limited the scope of adoption. In the meantime, there is limited demand for a single huge motor to drive the entire conveyor line in US mines. In comparison, rare earth prices in China are cheaper, so the price difference in raw material costs is one of the reasons behind the increasing penetration of permanent magnet motors in China.

Policy has always played an important role in driving energy saving trends and the promotion of high efficiency motors is currently largely fueled by regulations. China launched an ‘Industrial Energy Efficiency Improvement Action Plan’ in 2022, proposing that high-efficiency motors will account for more than 70 percent of newly installed motors by 2025. In the European Union, from July 2023 electric motors of continuous duty with a rated output between 75 kW and 200 kW must meet standards of IE4 or above. Encouraged by policy guidance and regulations, geared motor manufacturers are actively developing and promoting high-efficiency products. For example, SEW’s new motor factory, under construction in China, includes ‘permanent magnet synchronous motors and other efficient, energy-saving motors’ in its production plan.

Overall, the slowdown in the global manufacturing industry in 2023 is affecting general demand for all types of geared products. Amid short-term fluctuations, while gearbox companies are diving deeper to develop business in the existing markets, they are also preparing for medium- and long-term trends, implementing localization plans, and are actively developing high-efficiency products to meet future needs. For mature markets like geared products, companies have long been used to going through cycles and adopting long-term strategies.

https://interactanalysis.com/insight/geared-motors-and-industrial-gears-market-localization-and-energy-saving-continue-despite-demand-fluctuations/