The bearing and larger automotive market are already under strict anti-dumping legislation along with the full “75 percent” USMCA rules since 2023; additional tariff rules would not make a substantial impact on these markets as they are already highly regulated industries. “On July 10, 2024, the Biden Administration issued two proclamations Proclamation No. 10783, 89 Fed. Reg. 57347 (July 10, 2024) and Proclamation No. 10782, 89 Fed. Reg. 57339 (July 10, 2024) concerning imports of steel and aluminum products from Mexico and imports of aluminum products from Russia, China, Belarus, and Iran. The proclamations allow additional import duties of 25 percent for steel and 10 percent for aluminum to be levied on these categories of merchandise under the Trade Expansion Act of 1962.” (Refs. 1,2,3)

Bearing Manufacturers Perspective

I had the opportunity to discuss the 12-month outlook with several bearing manufacturers and while market and product strategies are different, everyone shared the same concerns about the uncertainty of the EV markets and tariffs.

Many companies have created new departments dedicated to electrification with the idea that the ICE market would slow down as the EV side picked up. With the current MPG standards, the automotive companies were forced to attempt to create an EV market which did not exist and does not exist at a very high financial loss. Making products for customers that do not exist is not sustainable for most companies. The bearing manufacturers are likewise forced to keep up with the artificial demand. Projections of millions of EVs that were already supposed to be here simply has not materialized. Again, we are seeing numerous program delays, cancellations, unfinished factories sitting idle while ICE demand remains strong. Manufacturers have no choice but to support the products that are in demand and allocate only the resources needed to support what now appears to be a slow growth, secondary EV market.

In the design space, electrified gearboxes continue to mature in design while designers continue to experiment with new architectures in attempts to further improve efficiency, performance, noise, and cost. It is a strange place we are in. The EV market was forced onto the industry through regulation in the name of efficiency. To entice new customers, the outrageous torque and power that multi-motor EVs can produce has been one of the largest selling points. If your EV isn’t a sub 4 second 60 mph, you can hang your head in shame.

On the engineering side, there is strong continued development in ULV (ultra-low viscosity) oils. It seems we are seeing a challenge area around 4cSt at 100°C. To maintain enough film to protect the bearings and gears, more aggressive additives are needed. The issue is, the additives are corrosive to copper if the oil is used to cool the motor. The obvious 3 options for these issues are: 1. Develop additives that are less corrosive to copper—not easy, cheap, or fast. 2. Use different lubricants for the gear and motor side. Mixing of fluids is always a concern, but not so different from the current motor oil, motor coolant and transmission fluid combination that we deal with every day with ICE architecture. 3. Dry motor housing with sealed bearings. The primary issue here is heat. The older style small motors can manage the smaller amount of heat generated in the dry motor sump but higher power 200 kW ++ motors can generate a motor-deteriorating amount of heat which is why wet sumps have taken over as the design preference in higher power applications.

Bearing damaging levels of stray electric current in motors continues to be a regular conversation. We know how to fix it; throw a ceramic ball bearing on the resolver side and a conductive ring on the gear side and forget about it. The problem is—that can be a $25 solution (add “million” to end to see how executives view that number). Hard rubber or plastic-coated outer diameters in lieu of ceramic are not new, but still not regularly found in high volume. On the grounding side, some companies are working on integrated the grounding into the bearing, but this is not an easy or cheap solution either. There is also talk of being able to limit the current on the motor side. All these solutions are still in discussion.

Regionalization is a big topic of conversation right now. This started before COVID, which would be a logical guess to when this started. Prior to COVID, we were seeing USMCA, anti-dumping, discussion of tariffs, fair trading practices, concerns about reliance on China, etc. We were seeing bearing manufacturers starting to talk about setting up factories in N. America for N. America. We are not the only place, we are seeing India, Europe, S. America all bringing products closer to the end user. COVID simply reinforced a trend that had already begun. Providing the legislation remains favorable, we expect this trend to continue.

Conclusion

A strong economy can fix just about anything. There is an old Wall Street saying that everyone looks like a genius in a bull market. We have discussed these large expenditures that are not seeing a return. A strong current product market can maintain these costs, to an extent, while secondary markets develop. The risk that everyone is very aware of is the high level of debt capital which will turn into a real problem if the economy softens. For this reason, companies are quickly pulling back expenses in the EV market and realigning with the ICE market where the current volume is. A potential silver lining—though at a cost much higher than silver—is when the EV market does develop, everyone is ready for it in the engineering and manufacturing worlds.

References

- Federal Register. “Tapered Roller Bearings and Parts Thereof, Finished and Unfinished, from the People’s Republic of China: Continuation of the Antidumping Duty Order.” Federal Register, 21 Mar. 2024, www.federalregister.gov/documents/2024/03/21/2024-05938/tapered-rollerbearings-and-parts-thereof-finished-and-unfinished-from-the-peoplesrepublic-of-china. Accessed 4 Jan. 2025.

- BDO USA. Mermigousis, Mathew, and James Pai. “Tariff Changes on Steel and Aluminum Articles from Mexico.” BDO, 17 July 2024, www.bdo.com/insights/tax/tariff-changes-on-steel-and-aluminum-articles-from-mexico.

- Dickenson Wright. “Summary of Automotive Provisions of USMCA*| Insights | Dickinson Wright.” www.dickinson-Wright.com, www.dickinson-wright.com/news-alerts/summary-of-automotiveprovisions-of-usmca. Summary of Automotive Provisions of USMCA* | Insights | Dickinson Wright.

- Morningstar, Inc. “S&P Global Mobility Forecasts 89.6M Auto Sales Worldwide in 2025.” Morningstar, Inc., 20 Dec. 2024, www.morningstar.com/news/pr-newswire/20241220ny84727/sp-global-mobility-forecasts-

896m-auto-sales-worldwide-in-2025. Accessed 10 Jan. 2025. - Cox Automotive. Campbell, Jaelyn. “Cox Automotive Forecasts Optimistic Growth for 2025 as Auto Market Momentum Builds.” CBT News, 7 Jan. 2025, www.cbtnews.com/cox-automotive-forecastsoptimistic-

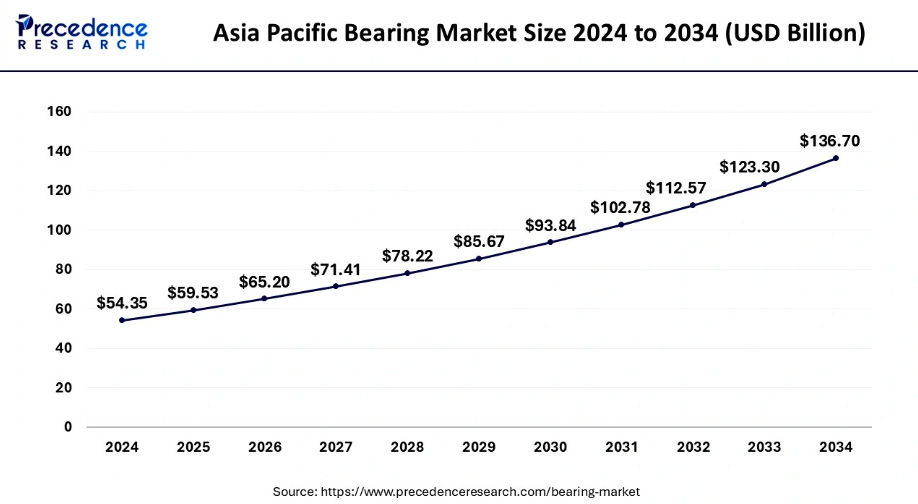

growth-for-2025-as-auto-market-momentum-builds/. Accessed 10 Jan. 2025. - Precedence Research. “Bearing Market Size, Growth, Trends, Scope, Report 2022-2030.” www.precedenceresearch.com, 5 Jan. 2025, www.precedenceresearch.com/bearing-market.

- US Customs and Border Protection. “USMCA Portal.” Cbp.gov, 2025, trade.cbp.gov/USMCA/s/article/Chapter-4-Rules-of-Origin. Accessed 10 Jan. 2025. 04-Rules-of-Origin.pdf.

- “Manufacturers: What You Need to Know about the USMCA.” Porter Wright Morris & Arthur LLP, 9 July 2020, www.porterwright.com/media/manufacturers-what-you-need-to-know-about-the-usmca/. Accessed 10 Jan. 2025.

- Barta, George. “Trump Planning to Slash Biden’s Fuel Economy Requirements.” GM Authority | General Motors News, Rumors, Reviews, Forums, 20 Nov. 2024, gmauthority.com/blog/2024/11/trump-planningto-

slash-bidens-fuel-economy-requirements-for-new-cars-and-trucks/. Accessed 10 Jan. 2025. - Lubrication Explained. “Wet vs Dry E Motors.” YouTube, 14 Oct. 2022, www.youtube.com/watch?v=d0XxySyL2SU. Accessed 11 Jan. 2025 Wet vs Dry E Motors - YouTube