IHS Markit Examines Low-Voltage Motors

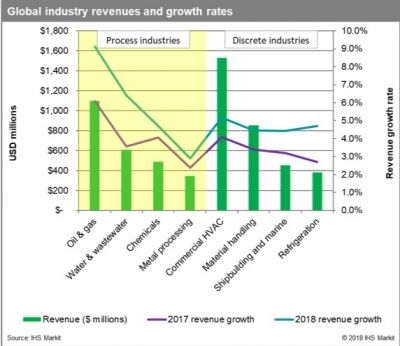

The low-voltage motor market contracted in 2016. Process industries were hit the hardest, largely due to depressed oil prices and oversupply concerns in the projects business. In 2017 the market experienced a recovery, and the process industries experienced the strongest upswing, especially the oil and gas sector. The top process industries grew at a faster rate than the top discrete industries in 2017, and this trend continued in 2018, according to the “Low Voltage Motors Report” from IHS Markit.

Rising oil prices led to a strong rebound in the oil and gas industry, which meant large projects that were previously delayed due to pending equipment purchases needed to capitalize on the industry’s growth. Most of the purchasing came from projects that were pushed in the Middle East, as well as additional investment into the United States. As the industry continues to receive more investment, global low-voltage motor sales in 2018 are expected to grow 9.1 percent, which is higher than the 6.1 percent growth in 2017.

Rising oil prices led to a strong rebound in the oil and gas industry, which meant large projects that were previously delayed due to pending equipment purchases needed to capitalize on the industry’s growth. Most of the purchasing came from projects that were pushed in the Middle East, as well as additional investment into the United States. As the industry continues to receive more investment, global low-voltage motor sales in 2018 are expected to grow 9.1 percent, which is higher than the 6.1 percent growth in 2017.

Global low-voltage motor sales in the water and wastewater industry also experienced modest growth, with revenues growing at an estimated 3.7 percent rate in 2017. The growth in sales was caused by a 6.3 percent increase in global residential and nonresidential construction spending, which is projected to increase by 7.1 percent in 2018.

Ongoing droughts in Southeast Asia have also boosted demand for motors used in pumping applications. Since irrigation infrastructure in the region has aged, many motors were purchased to upgrade existing pump systems. China continues to show strong growth in water utilities and recycling sales, boosting the industry in the Asia-Pacific region with roughly 3.5 percent revenue growth in 2017. North America and Western Europe, on the other hand, are lagging behind the market average. Most opportunities in these regions will come from the energy industry, as oil and gas plants require large amounts of water to operate.

Global low-voltage motor sales for the metal processing industry grew 2.3 percent in 2017, compared to the previous year, due to increased investment in Vietnam, Iran, Algeria, Qatar, Mexico and other growing economies. India’s manufacturing sector is also experiencing growth, thanks to continued government infrastructure spending, which boosted the construction and mining activity required for India’s manufacturing sector.

U.S. tariffs on steel and aluminum imports have increased demand for domestic steel, causing U.S. steel manufacturers to heavily invest in new equipment to keep up with demand. The future of U.S.-imposed tariffs, and the sustainability of the corresponding recent growth in the U.S. metal processing industry, remains uncertain.

On the other hand, China has been suffering from closures of multiple metal processing factories, caused by the Chinese Ministry of Ecology and Environment crackdown on facilities that are not in compliance with new environmental standards. Since China produces half of the global output of aluminum, the decline in production stifled the global metal processing industry growth rate.