IHS Reports on Low-Voltage Motor Market

Since the third quarter of 2014, the low-voltage motor market (i.e., integral horsepower motors rated at or below 690 volts) has struggled amid the numerous economic and political headwinds. In fact, according to the latest IHS Markit information, the global low-voltage motor market will decline nearly 13 percent, from $11.8 billion in sales in 2015 to $10.3 billion in 2017.

Despite this challenging environment, Preston Reine, senior analyst at IHS Markit, believes there are opportunities for motor suppliers that can adapt to the impending technological trends suppliers require. For example, motor end-users are increasingly interested in energy-efficient motors that will live longer and reduce full lifecycle costs. As the industrial internet of things (IIoT) continues to grow in customer recognition and adoption, motor manufacturers are also starting to find ways to leverage this trend to offset weak sales.

While there are reasons to be optimistic, the current political turmoil certainly harms growth prospects for the entire industrial automation equipment market throughout the next two-to-three years. As the global economy adjusts and recovers from shocking events, such as the British exit of the European Union and stalling oil prices, the low-voltage motor market revenue will decline very slightly, at a compound annual growth rate (CAGR) of negative 0.2 percent from 2015 to 2020. However, a strong recovery is expected to begin in 2018.

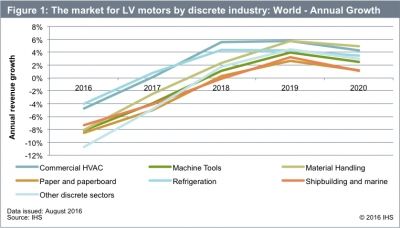

While heavy industries exposed to oil and gas investment levels are not currently good areas for motor growth, there are still several industry sectors that have outperformed – or that will outperform -- the market average in the short-term. For example, the U.S. housing market is expected to experience strong growth, as is non-residential construction spending, which bodes well for motors sold into construction, infrastructure, and HVAC applications.

A fast-growing population and rapid urbanization is also expected to cause motor shipments for food and beverage, water and wastewater, and power sectors to outperform the market average. In general the discrete manufacturing (machine builder) sectors are forecast to perform better than the process manufacturing (end-user) sectors.

After accounting for more than 26 percent of revenues in 2015, IE1 (standard efficiency) motors are forecast to comprise 25 percent of global low-voltage motor market revenue in 2016, and 16 percent by 2020. These products are sold mainly in the emerging markets that have yet to adopt any type of efficiency regulations; however, many leading suppliers are still successfully selling these motors in the United States, Germany and other developed countries.

As emerging and developed regions continue to push for more efficient motors, IE2 (high efficiency), IE3 (premium efficiency), and IE4 (super-premium efficiency) motors will continue to experience growth with revenue CAGRs of 1.6 percent, 4.8 percent, and 11.3 percent, respectively. It is worth noting, however, that IE4 motors accounted for slightly more than 1 percent of total motor market revenues. Therefore, it will take a long time for this technology to be considered a dominant customer trend.