Morehead allows that “Unexpected tariff burdens are a fact of life today, where gearmotors possess content sourced from China and has prompted U.S. gearmotor manufacturers to look toward other low-labor-cost APAC (Asian-Pacific) countries for component or motor sourcing. Of course, the warning signs have been there for years and basic global economics foretell that the advantages of low labor and material costs are fleeting as economies develop. If all you make today is a standard-design gearmotor, you’ve set yourself up for global commoditization.

“While it’s more important today than ever to provide the best application and design engineering support, along with highest quality and shortest lead times, it is becoming evident that customers are looking for more than just a gearmotor. Those gearmotor manufacturers who can also provide motor controls, cabling, brakes, encoders, brackets, shielding, enclosures and anything else customers will find advantageous to purchase as a sub-assembly will be rewarded with a stronger customer relationship and increased insulation from competition.”

For Holling, in much the same vein, “These motors are becoming a commodity item with shrinking margins and strong price competition from China and others, which makes them less attractive to U.S. producers,” says Holling. “Unless the supplier can offer a value-added which commands better margins, the U.S. is not competitive.”

Meanwhile, seemingly, everything is a moving target in today’s automated, bot-driven world. And highly sophisticated, software-driven motion control is now manufacturing’s meat du jour. So where do, say, brushless DC motors fit in?

“Integrating the control required to make the brushless motor turn with the motor only makes sense in terms of eliminating costs of cabling and enclosures, while simultaneously eliminating electrical interference issues,” says Morehead. “In addition, the OEM’s installation time and cost are reduced and field servicing, which is always a burden, is greatly simplified. The OEM’s greatest source of frustration is when a motor-and-drive problem arises and they’re faced with finger pointing from two separate sources. Simple speed controls are just the first step and the gearmotor manufacturer’s controls capability needs to eventually expand to positioning and networking to ensure being able to offer the highest-value, differentiated gearmotor solutions.”

Holling explains that “Integrated controls can simplify the machine design, wiring costs etc. Thus, an integrated controller is a prime example of a value-added service that customers value and pay for. An integrated controller can also reduce design time and cost for equipment. Allow for future upgrades and field replacements (repair with different or generic components), and the reduced wiring and connections can potentially improve reliability.”

“These motors are becoming a commodity item with shrinking margins and strong price competition from China and others, which makes them less attractive to U.S. producers,” Holling says. “Unless the supplier can offer a value-added which commands better margins, the U.S. is not competitive.”

John Morehead, principal consultant

Motion Mechatronics

104 E. State Street #412

Sycamore, IL 60178

Cell: (224) 401-2161

motionmechatronics.com

George Holling, CTO

Rocky Mountain Technologies

P.O. BOX 210

Basin, MT 59631

rockymountaintechnologies.com

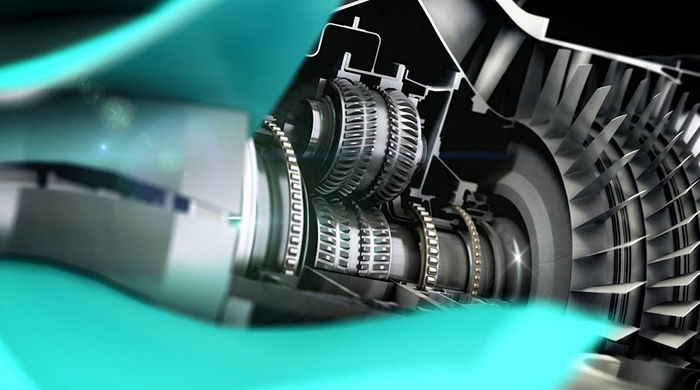

Direct Drive and Hybrid-Servo Motors — with or without Gears

Newer-technology direct drive and hybrid-servo-type motors are enjoying increasingly more pervasive market share. The following is from a company — QuickSilver Controls Inc. (QCI) — focused on making these types of motors. But they do have some users that add gearheads to the motors. They have also worked with customers using harmonic drive gearmotors for certain applications as well. These comments are from Don Labriola, QuickSilver president and founder.

On relevancy of gearmotors relative to hydraulics used in electronic actuators; most common industrial applications

- We have seen the replacement of hydraulics with electronic drives in molding applications due to reduced fire risk and reduction of environmental recovery costs associated with spills of hydraulic fluids. In entertainment systems, the high power density of new electronics systems as well as the high efficiency has allowed removal of the hydraulics in many systems, preventing both the environmental cleanup as well as customer exposure to hydraulic vapors which can result from small pinhole leaks. The degree of maintenance and requirement of maintenance knowledge appears to be significantly lower for the electronic actuators, the electronic actuator having longer periods between maintenance.

On efficacy of gearmotors/actuators in applications requiring high power densities

On value-added actuator solutions

- QCI has made (its) business from integrated motion control as well as remoted control boxes. Many of our applications are able to run direct drive due to the high continuous torque ratings produced by hybrid-servo motors and to their high torque constants and high motor quality factors Kq = Torque/sqrt (power). Software allows variable torque, variable speed, emulation of particle clutch, as well as many communications options and onboard programming through customer-friendly development environments. When a gearmotor is required, hybrid servos can typically reduce the number of stages due to the high motor torque available, as well as the high inertial mismatch capability of hybrid- servo motors.

On control integration as a key driver in the growth of brushless DC motors

- Integrated fault detection, precise motion profiles, gentle starting and four-quadrant control of the motion — simple-to-complex program capability — are all built into the motor package. This significantly reduces the integration effort, cabling volume, and costs. Total system performance is also well parameterized from the data sheets, and integration design is reduced.

Jack McGuinn

Don Labriola, president & founder

QuickSilver Controls Inc. (QCI)

990 N. Amelia Ave

San Dimas, CA 91773

Phone: (909) 599-6291

quicksilvercontrols.com