“What’s the market segment? Is the part going to be inside something else or is the part going to be externally exposed to the environment? Are there certain aesthetics that need to be considered? Where does the actuator actually sit?” Lyon said.

Highly customized products are so important because customers want the most efficient and practical components available.

“Traditional performance requirements are a given, but you also have space constraints, right? Let’s pack this into the tightest little box we can. When you do this, if it’s in an enclosure, thermals will inevitably come into play. How efficiently this actuator can dissipate and remove heat from the system is critical because this is what ultimately drives the rated torque values for motors based on their current flow. If the motor heats up too much, efficiency crashes and the system you designed to operate at a certain speed and torque is not going to be able to perform as expected,” Paschke said.

Power consumption is also increasingly critical in 2023. Paschke said that in the past customers didn’t need a comprehensive overview of power consumption. “They’re looking at every single power draw from each component in the system even for the small accessory-based sensors. A lot of those things are being more heavily considered today because efficiency is not only important to the OEM, but to the end customer as well.”

Design considerations continue to focus on smaller, faster, and stronger components, a move toward lower weight, higher power, and better efficiency.

“When you get into the actuation side, reducing weight comes into play. This regularly comes up in engineering discussions. How do we make this lighter? How do we make the motor more efficient? How do we reduce the friction in these bearings? How do we make sure this joint is stiff enough that it will maintain accuracy? How do we make it lighter and more efficient but maintain the strength and rigidity we need to do the job the robot is being designed to do,” Syndergaard said.

Hooker compared it to a packaging exercise.

“How do you package the functionality in a way that fits the equipment? Typically, that’s all about size and weight.”

The other factor is simplification and smarts, adding intelligence into the device, for example.

“A customer would rather have smart functionality built into it—you can do your own motor control, diagnostics, read the sensors, etc.—versus having to develop these as a second step. This is also one of the more complicated things to integrate into the design as well, so it’s easy to see the value in providing these capabilities to our customers,” Hooker added.

As robotic technologies evolve, so too must Schaeffler’s design range.

“In 2023, we’re facing new challenges with the movement toward smarter robotics, smarter components, sensors that tell you exactly where you’re at regarding torque, etc. In addition, the types of robots are changing. We’re seeing a greater emphasis on cobots interacting with human workers. There are a lot of opportunities here instead of the old caged robotic arms designated for a single task on the shop floor. Cobots offer increased flexibility and additional capabilities and will continue to evolve in the future,” Hooker said.

Hand guidance—the ability for a human to grab the robot arm and teach it a certain task—that’s a great feature, but it requires so much more in terms of adding sensors. Safety is an issue, of course, and you’ll also need some amount of torque sensitivity in the joints. Syndergaard said Schaeffler’s strain wave gearbox portfolio contains a built-in sensor that minimizes the tradeoffs with other factors such as strength, weight constraint, etc. These capabilities are so important for cobot applications.

“This technology is really interesting regarding both the weight and space requirements,” Hooker said. “Torque sensing is needed at the output of the gearbox so that you don’t hurt someone. You can’t sense it on the input side as easily because of the high ratio gearbox. The traditional way to do this is to attach a torque sensor to the output of the gearbox and then that’s connected to the load and you can determine the force feedback from the robot very accurately within a few newtons or less.”

Sensotect is a coating developed by Schaeffler that allows the measurement of the load condition at locations where classic sensors such as adhesive bonded strain gauges cannot be used. The functionality is achieved by means of a strain-sensitive metal coating with a thickness measured in the sub-micrometer range that is structured by micro-processing. This measurement structure allows the continuous measurement of force and torque during operation.

With the aid of modern thin film technology, the component becomes a sensor and the sensor becomes a component. Due to this measurement technology, it is possible for example to determine the torque of drive shafts or in vehicle gearboxes very quickly and precisely.

“We apply this coating to a surface and measure the strain on the part,” Hooker said. “The benefit is maintaining highly torsional stiffness. We can integrate this and check all those boxes in a way existing technology just doesn’t do.”

“In 2023, we’re facing new challenges with the movement toward smarter robotics, smarter components, sensors that tell you exactly where you’re at regarding torque, etc. In addition, the types of robots are changing. We’re seeing a greater emphasis on cobots interacting with human workers. There are a lot of opportunities here instead of the old caged robotic arms designated for a single task on the shop floor.”

—Craig Hooker, director research and development, industrial and mechatronics at Schaeffler.

Software Considerations

Even though a customer has a distributed system, what they want is to be able to command an actuator to react to their host message. If it’s a joint on an arm, it needs to turn at a certain position and speed, for example.

“Our customers typically don’t want to do the motor control. They want a device they can command, and it reacts to these commands. When we’re involved in many of these robotic applications, we develop within the device to control motor function, read sensors as feedback, and report out—or listen to a host as the third step,” Hooker said. “This gives us the ability to add value and still be plugged into a system where the customer can determine what the machine does. They need to have the next-level control in those kinds of systems.”

And how is this different between the DAP and PAP design paths?

“When you PAP,” Hooker said “you buy an existing controller, for example, and you’ll buy a specific software set. This will give you an advantage when it comes to speed to market. You don’t have to develop drivers and all these sub-level interfaces that are required. You don’t have to understand too much about motor control. However, you lose some flexibility, pay more for it and it doesn’t integrate as well.

On the other side, if you said, ‘I’m going to make a million of these devices and I really want it to be a perfect product for my application,’ then you’ll probably want to take that to a much more complex level—what microchip do I want to use? I want to write my own firmware and really drive it down to a highly specific design which will allow you to save space, add features that add a specific value, and it will allow you to get to a much better cost point,” Hooker said.

Editor’s Note: I recently toured the facility in Spring 2023 and was amazed at the high level of machining and automation taking place at the facility. I’m excited to learn more about their future expansion into the robotics and industrial automation market segments.

|

“It all comes down to in-house engineering power,” Paschke said “Designing the system from the component level or going deeper down and choosing your own materials is going to take quite a bit of mechanical engineering design. You’re also going to need to consider the software side, motor control, etc., which means you must be able to understand both the hardware and software side of things. So, PAP may save you in terms of your internal engineering resources.”

“We’re facing an application right now where we have a significant cost-savings opportunity on the table and the hang-up is that their mechanical guys want to do it, their purchasing guys want to do it, their operations guys want to do it, but they don’t have the horsepower on the controls or software side to really accommodate the changes,” Lyon said.

Field Notes in Robotic Actuation

Robotic arms have multiple axes and backlash has become increasingly important. Everybody wants these robotic arms to go quicker and faster. They want to know how to get the most efficient and robust technology on the shop floor.

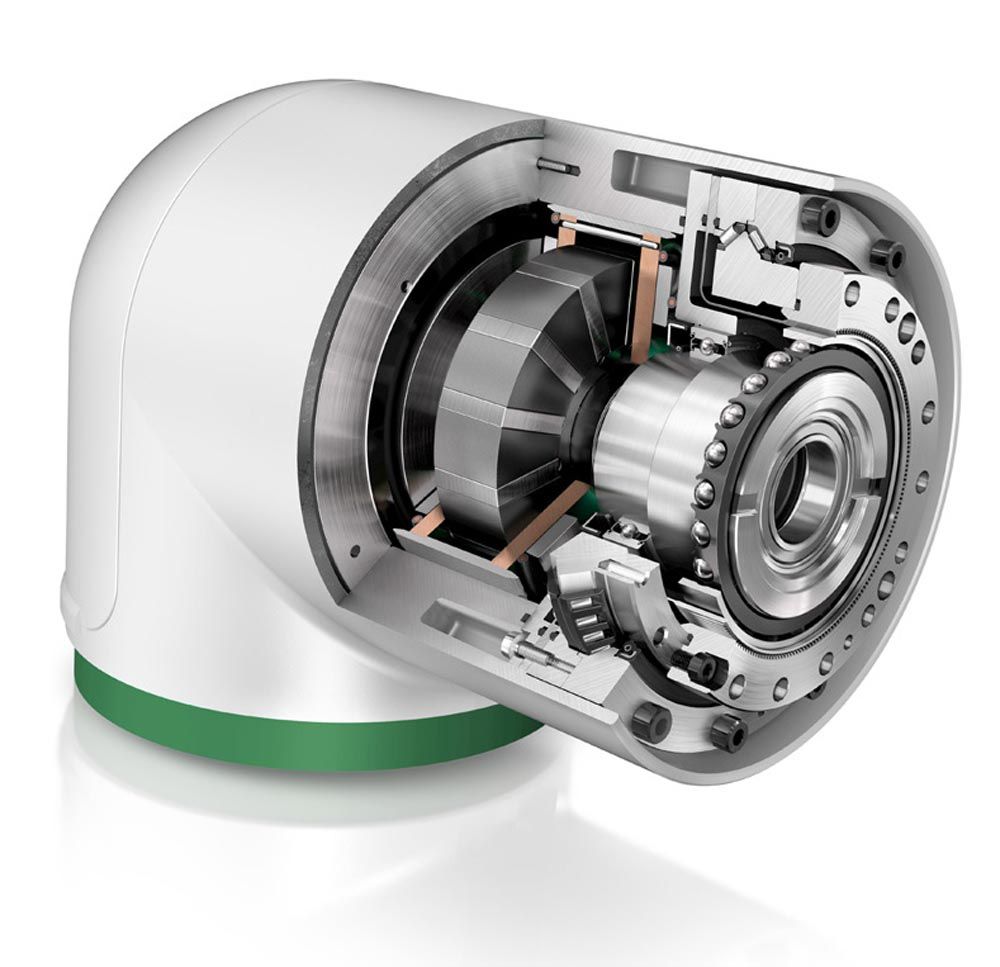

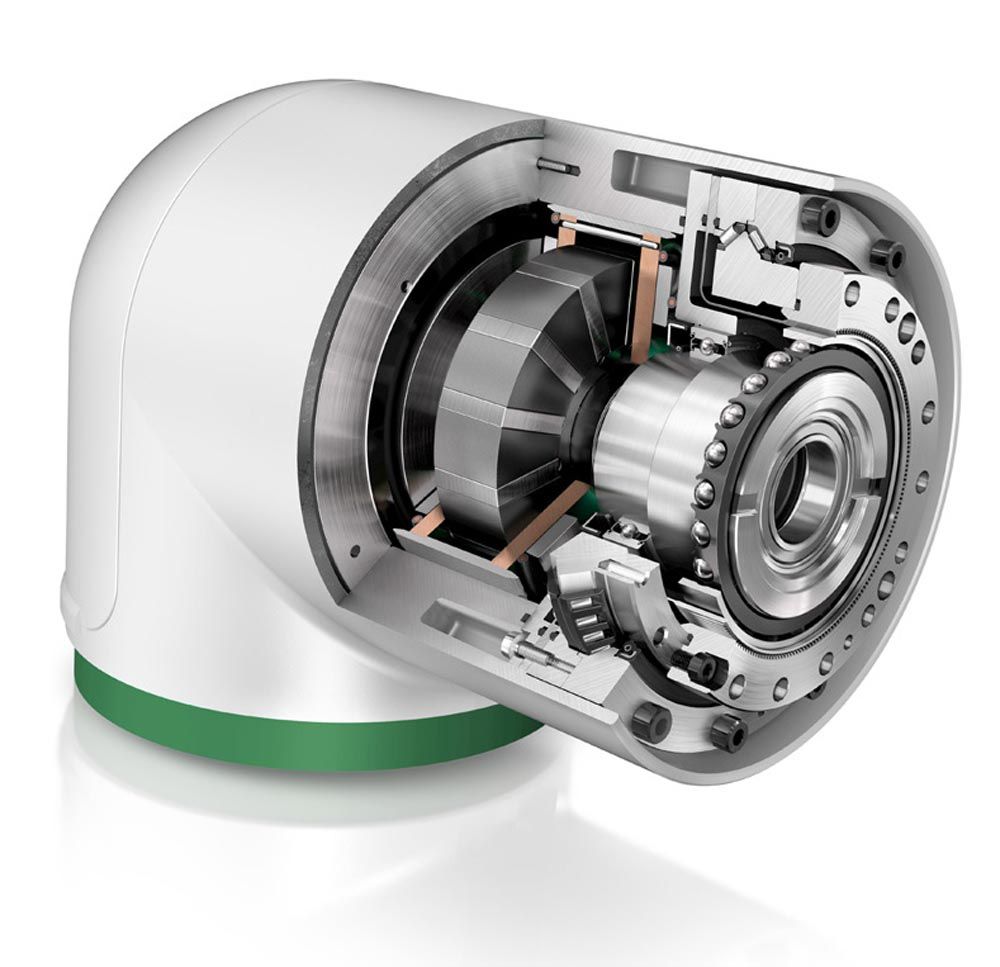

In 2022, Schaeffler acquired Melior Motion GmbH (now Schaeffler Ultra Precision Drives) a company based in Hamelin, Germany, that develops an innovative planetary gearbox for industrial robots that is highly precise, features outstanding repeat accuracy, low noise emissions as well as very sound robustness.

Compared to traditional planetary gears, gearsets from Schaeffler Ultra Precision Drives are a lot more precise. In concrete terms, this means: You have a torsional backlash of ≤ 0.1 angular minute and a lost motion of ≤ 0.6 angular minute. Even many cycloid gears are limited to a torsional backlash of ≤ 1 angular minute – Schaeffler’s PSC gears are up to ten times more precise. This very high accuracy has its origin in the conical toothing of the second stage. This presses the teeth of the planetary gears into one another and ensures that the transmission is free of backlash and will remain so for the life of the gearbox. The company has been developing precision gears for robotics manufacturers and applications in industrial automation for over 30 years.

After many years of collaborating with Kuka, Schaeffler’s new, innovative precision gearbox was qualified for two industrial robots as well and is currently installed in two axes of the KR Cybertech and six axes of the KR Iontec. As a result of these products’ success in the market, which is driven by the features of the new drive concept, Schaeffler Ultra Precision Drives will continue to expand its capacity in the coming years.

powertransmission.com/blogs/1-revolutions/post/9212-planetary-gear-rethought

Future Approach

The market potential of robotics and industrial automation continued to expand in areas such as industrial robots, cobots, AGVs, mobile professional services, stationary professional services and more. A consumer-driven demand for faster, lighter, and more efficient systems will advance a variety of robotic applications in the coming years.

In short, technology is going to drive costs.

“If you look at some of the products we’ve recently released—integrated torque sensors or planetary gear units—these are fundamentally new things that help improve robotic applications,” Hooker said. “I think there’s much more room to grow in these areas and I think as we see continued growth in cobots working side by side with people you’re going to need a structure that can produce those robots cheaper than they’re produced today.

We see a pathway to produce precise robotic equipment at high volume, and we’re eager for this market to develop because we think Schaeffler can bring some innovative new products and technologies to the table.”

schaeffler.us