Global Industrial Outlook: Oil Slick Cascading Through Sector

Global Industrial Outlook: Oil Slick Cascading Through Sector

Brian Langenberg

Third-quarter earnings are confirming the worst-case scenario, i.e. — not only are energy- related end markets in a downturn, but conditions continue to worsen.

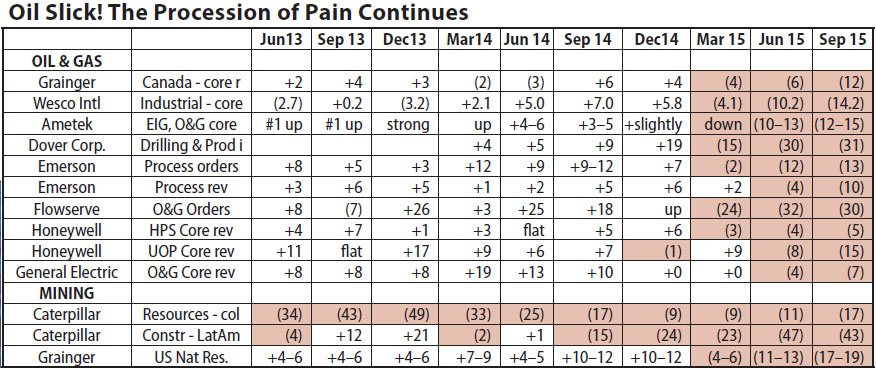

Maintenance, repair and overhaul (MRO) is holding up relatively well (which actually means down less), but upstream activity is getting killed. Two companies with “big project” oil and gas exposure are citing bad pricing with Emerson stated, “worse we’ve seen in years,” and Flowserve confirming, “down 5-10%,” on large projects. Here are energy-specific results for selected companies, quarter-to-date:

Canada will offer no respite. Not only will low oil prices (and the associated strong dollar) continue to weigh on energy and exports, but I also think you can kiss the Keystone Pipeline goodbye — even after 2017. New Canadian Prime Minister Justin Trudeau has voiced some support for Keystone XL, likely meant to garner electoral support out of Alberta; but his heart is with the “climate change” crowd and repairing Canadian relations with Obama. His life story and track record do not scream “drill baby drill.”

Partial off-sets are on the horizon beyond 2016 from non-residential construction, improving home prices and municipal budgets. Caterpillar voiced optimism about a highway bill before year end which, now that we have a speaker, is possible. However, it is more of an extension of current activity and hardly a “rebuild the country” move.

Machinery outlook for ’16 is negative. Aside from truck (replacement mostly), expect continued negative comparisons from oil and gas, mining, agriculture, and power generation.

Focus Company: General Electric (GE)

Suppliers to GE’s Power Generation business take note. The Alstom deal is closed now and it is game on for them to find cost outs and supplier consolidation with the assets and business of Alstom. A major initiative of theirs will be building an effective service business in Europe to support the installed gas and coal assets of Alstom. This may be opportunity for you — or it may be a threat. Studying your exposure by product line is critical now to assessing your risk. CEO Jeff Immelt wants to go out with a win and this will be his trophy deal — or his albatross.

Further your career: On July 1, 2015 I took over as Chair (and Lecturer) of Graduate Business Programs at Aurora University. The Dunham Graduate School of Business MBA with a Leadership concentration is ideally suited for technical or engineering professionals seeking to gain the business skills, tools, and mentorship to further their careers. AU also offers adult degree completion programs.

Highly accomplished professional business people teach our courses, whether on ground or online (same professors).

Front-end career goal discussion and mentorship. We want you to succeed.

Rolling admission with six 8-week terms per year allows you to flex up/ down depending upon your needs.

Focused curriculum: 12 classes — 7 core, 5 electives. Each core class is a basic building block you need; the electives are geared for your objectives.

Locations: Aurora, Illinois, Woodstock, IL and Online.

Contact blangenberg@aurora.edu to

arrange for a phone or in-person discussion.